Triple-digit annualized returns and moonshot token prices are followed by crash and burn endings as often as not. While the DeFi markets have a lot to offer by way of circumventing centralized companies that typically offer finance, banking, and other services, DeFi is not without substantial risks. And the market shows limited, if any, signs of stopping, as new DeFi protocols are seemingly released every week. dollars are locked within various protocols, an increase of over 39x since the same time last year. The prevalence of DeFi (aka Decentralized Finance) has increased exponentially over the past year as investors and crypto fans alike have rushed to cash in on protocols that can replace everything from banking and hedge funds to insurance and prediction markets. In this case, Aave uses Ethereum, enabling users to deposit tokens in return for a passive income of tokens in the same way a lender would receive interest whilst borrowers to receive either with or without collateral.Are you brand new to crypto and not sure where to begin to learn about it? Check out my intro to cryptocurrency and intro to blockchain posts and my cryptocurrency blog to learn more about this fascinating new technology! You don’t have to get approval from anyone and it takes minutes to take out a loan,” Cuban said about earlier this year.Īave is described as a “decentralised non-custodial liquidity market protocol” which, in practical terms, means it allows users to either lend or borrow funds via a decentralised ‘pool’ of crypto tokens. “Everything is controlled by smart contracts.

Mark Cuban, famously one the investors in the Shark Tank television show, owns the Dallas Mavericks NBA team and has been a bullish proponent of cryptocurrency, decentralised finance and blockchain technology.Īs recently as Tuesday, in his own blog, he wrote that “banks should be scared” as decentralised finance (or DeFi) systems grow to challenge traditional finance operations and institutions.Ĭuban has previously been particularly vocal about a DeFi platform called Aave. At one point some US$2bn of value was ‘locked’ in smart-contracts (a type of contract on a blockchain) tied to IRON and TITAN.

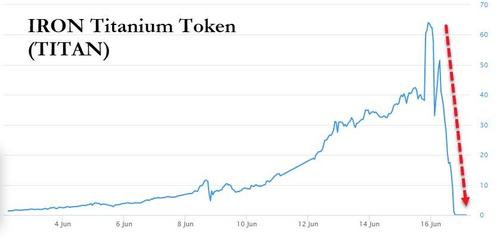

The IRON stablecoin was attached to the Polygon blockchains platform. What happened is just the worst thing that could possibly happen considering their tokenomics,” Schebesta. On social media, some internet users speculated that the TITAN collapse was a ‘rug pull’ which is a type of scam where crypto systems are shut-down, in a similar fashion to a more traditional ‘pump and dump’ share trading scheme.įred Schebesta, an IRON investor quoted by Coindesk, called it a “crypto vortex of money.” It got messier still, according to a Coindesk report, which explained that an arbitrage trade exploiting the difference between the relative prices of IRON and TITAN resulted in yet more TITAN coins being sold. Selling by speculators that had cashed in on the rise in TITAN’s price caused the ‘peg’ to become unstable, with panic selling sending a flood of tokens into the open market to further exacerbate the collapsing value. Unfortunately for anyone left holding TITAN coins the flywheel that sent it soaring also worked in reverse. The price of TITAN peaked at US$65 per coin as recently as Wednesday. IRON was 75% pegged to USDC – a US dollar pegged stablecoin created by crypto-exchange Coinbase – but the other 25% was pegged to TITAN, which was to be used as units of collateral.Įvidently, the catch was that as more IRON coins were ‘minted’ due to rising popularity the price of TITAN was driven up. They typically do this by through an external attachment, or ‘peg’, to some other representation of value (like a Dollar or perhaps a unit of gold). To keep it simple, a stablecoin is intended to be a non-volatile crypto asset. 'Tokenomics' was blamed for the imploding of TITAN which ironically was supposed to be tied to another crypto token, called IRON, which was designed to be what crypto-heads call a ‘stablecoin’. The extreme volatility event came only days after Cuban revealed in a blog post that he was a liquidity provider to the system. Mark Cuban, the American celebrity billionaire, was reportedly ‘hit’ by the crypto’s collapse but said on Twitter that he “got out”. A crypto token known as TITAN both boomed and bust in the same 24 hours, with its value ultimately flat-lining to zero in what has been described as a “vortex of money”.

0 kommentar(er)

0 kommentar(er)